-

Rigetti Computing (RGTI) fell 40% in a month as CEO Subodh Kulkarni sold his entire position at $12 per share.

-

Rigetti generated just $1.95 million in revenue in the third quarter and burned through $200.97 million in cash.

-

The company trades at 1,033 times sales with a market capitalization of $7.74 billion despite a revenue decline of 18.1%.

-

Some investors get rich while others struggle because they never learned that there are two completely different strategies for building wealth. Don’t make the same mistake, learn about both here.

Actions of Rigetti Computing (NASDAQ: RGTI) has plummeted 40% over the past month, falling from $39 in early November to $23.45 on December 1. The drop coincided with a dramatic shift in retail investor sentiment, falling from bullish scores of 78-82 in late November to very bearish readings of 12-18 in early December on platforms such as Reddit and valuations across the quantum computing sector.

Retail traders on r/wallstreetbets are obsessed with insider selling patterns. CTO David Rivas and CFO Jeffrey Bertelsen sold shares on Nov. 20 at $26.34 and $26.35 respectively, just as the stock was plunging. More worrying for investors: CEO Subodh Kulkarni sold his entire position at $12 per share and does not currently own any shares. One detailed bearish post gaining traction quotes a Reddit user writing, “RGTI: Insiders continue to cash out; down 69% (give or take…)” and points to the executives’ selling pattern during the stock’s decline.

RGTI – Insiders continue to withdraw money; down 69% (more or less…)

by

u/dnr41418 on

wallstreet bets

The financial outlook supports the bearish sentiment. Rigetti generated just $1.95 million in revenue in the third quarter, down 18.1% year over year, while burning through $200.97 million. The company trades at a staggering 1,033 times its market capitalization of $7.74 billion. Three fundamental concerns dominate the discussions:

-

Revenue fell 18.1% year-on-year despite quantum computing hype

-

Cash burn rate requires continued dilution through ATM offerings

-

Commercial quantum computing is more than 10 years away, CEO comments

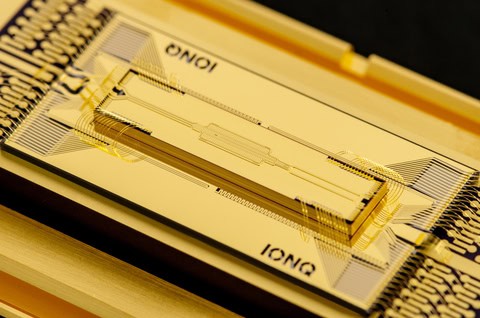

IonQ (NYSE: IONQ) fell 42.6% from its October high of $82.09 to $47.12, while Quantum Computing Inc. (NASDAQ: QUBT) plummeted 55.5% from $24.62 to $10.95. All three stocks peaked in mid-October before retail enthusiasm evaporated. IonQ trades at 209 times sales with revenue of $79.8 million, while QUBT is at 4,495 times sales with just $546,000 in revenue. Both remain deeply unprofitable with negative operating margins exceeding 1,000%.