When French telecommunications company Altice acquired U.S. cable companies Cablevision and Suddenlink, Chairman Patrick Drahi made a bold statement: Altice USA would rival Comcast and Charter in size, becoming one of the three dominant U.S. cable operators.

Fast forward nearly six years, and Altice USA has about 5 million customer relationships, compared with about 31 million each for Comcast and Charter. (Altice USA did announce a $310 million acquisition of Morris Broadband on Monday, which will give it about 36,000 more customers.)

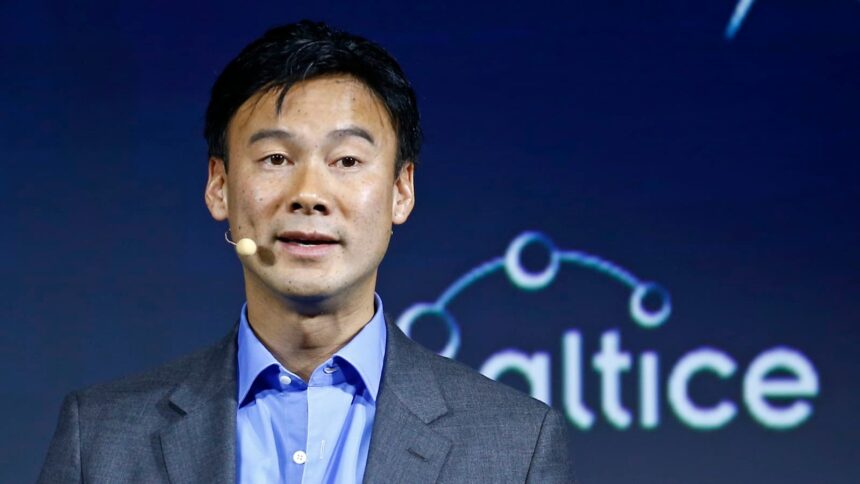

CEO Dexter Goei explained to CNBC what prevented Altice USA’s rapid expansion, why he thinks cable and wireless will eventually merge in the U.S., and why it’s only a matter of time before cable TV becomes extinct.

The reality is there’s been nobody selling, nobody of size — of any credible size. And so with all the goodwill that we have and the expertise and the things that we think we can do — probably slightly better than some of our peers in acquiring businesses — we haven’t had the opportunity to show our stripes again of anything of meaningful size. The biggest transaction was something that that Cable One just acquired for a couple of billion. And that was very specific to to certain regions that we’re not in.

I don’t know, other than what’s clear is most of the existing current owners of other assets out there that are not ourselves, Charter and Comcast, including Cox, by the way, are owned by families that have been in the cable business pretty much since the 70s, when cable franchises were being allocated and cable networks were being built.

And that’s pretty much across the U.S. People have been owners for 10, 20, 30 years, more. And if you speak to a lot of these people they all say the same thing, which is, one, we like the business. Number two is we understand it’s created a lot of value, and we don’t need the money. And so we’re just going to continue to do what we do. And I think they very much like being pioneers in their respective communities. Your cable operator, particularly some of the smaller cable operators, are really big mainstays of the business community. And so all of that makes sense if you really don’t need the money and don’t know what to do with the money. These businesses are generating a tremendous amount of free cash flow. And so, yes, you could probably sell at five billion. But if you’re getting whatever, you know, three or four hundred million of dividends every year, it’s not like it’s not like there’s anything else to do.